Flat rate VAT is just one of many schemes set up by the Government to make VAT easier for small businesses. Over time there has been conflicting information published about whether the flat rate scheme is actually beneficial for small businesses or not. This article will give you the facts and provide you with example calculations so that you can make up your own mind.

What is the flat rate scheme?

As explained in our “An overview of VAT” helpsheet, the traditional invoiced based VAT system allows businesses to charge VAT on their sales, deduct VAT from their purchases, and then pay over the remainder to HM Revenue & Customs on a quarterly basis.

The flat rate scheme still requires businesses to charge their customers VAT at the appropriate rate (the standard rate currently being 20%), but they are not allowed to claim back the VAT spent on their purchases. In exchange for this, HMRC will only ask the business to pay over a prescribed percentage of VAT (which tends to be less than the standard 20%) based on what line of business they are in. This prescribed percentage is charged on the gross sales of the business, and this is all that is paid over to HMRC.

What are the prescribed percentages?

HMRC have predetermined the flat rate VAT percentages for each industry. A few of these are listed below:

|

Computer and IT consultancy or data processing |

14.5% |

|

Estate agency or property management services |

12% |

|

General building or construction services |

9.5% |

|

Management consultancy |

14% |

|

Pubs |

6.5% |

To see the full list you can check the HMRC website at https://www.gov.uk/vat-flat-rate-scheme/vat-flat-rates

**Point to note** HMRC reduce your flat rate percentage by 1% in your first year of adopting the scheme.

Example

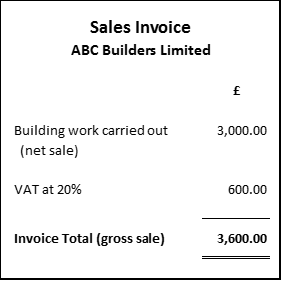

ABC Builders Limited is a company who offers general building and construction services. The prescribed percentage given to them under the scheme would be 9.5%. ABC Builders Limited invoices their customer for £3,000 of building services. They spent £1,100 in materials for the job (all costs are VAT exclusive).

Regardless of which scheme the company is operating under, the sales invoice will always look like this:

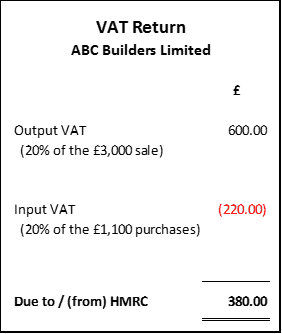

Standard scheme

Under the standard invoice based VAT scheme ABC Builders Limited would have a VAT liability of £380.

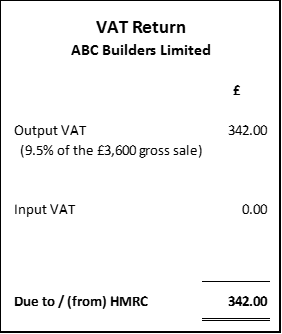

Flat rate scheme

Under the flat rate VAT scheme ABC Builders Limited would have a VAT liability of £342.

Therefore in this example the flat rate scheme would be better for ABC Builders Limited. But look what happens when you increase the purchases to £1,600.

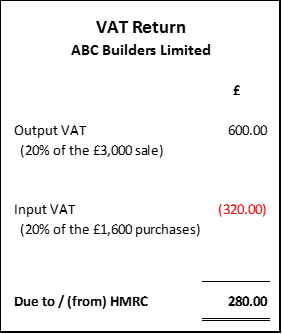

Increase the purchases to £1,600

ABC Builders Limited would be liable to VAT of £280 under the standard scheme, but still liable to £342 under the flat rate scheme.

Conclusion

As you can see, the flat rate scheme is not a “one size fits all” type of solution to save small businesses money. In fact, flat rate VAT tends to only be beneficial to businesses that have a large profit margin. Businesses operating with a relatively small profit margin will tend to see lower VAT liabilities under the traditional invoice based VAT scheme.