If you work on a construction site or know someone that does, then the term Construction Industry Scheme (also known as “CIS”) is one you will be familiar with. But do you know exactly what it means to fall under the scheme? Here we will give an overview of the scheme and detail each person’s responsibilities under it.

What is CIS?

The Construction Industry Scheme was set up to govern payments and tax deductions between individuals and businesses who work in the construction industry. With a few minor exceptions, if you work on a construction site you must be registered under the scheme.

What is a contractor?

A contractor is an individual or business that pays people to work on construction sites.

What is a subcontractor?

A subcontractor is an individual or business that works on a construction site and is paid by a contractor.

**Point to note** it is the duty of the contractor to ensure that the subcontractor is a legitimate subcontractor and not a “disguised employee”. Please refer to our recent article about IR35.

Payments to subcontractors

Under the scheme contractors are required to pay subcontractors in accordance with their registration status:

| Not registered | deduct 30% |

| Registered | deduct 20% |

| Registered as Gross Payment Status | no deduction |

What is the deduction for?

Contractors under the CIS scheme essentially act as tax collectors for HM Revenue & Customs (HMRC). They deduct the specified tax percentage from the subcontractor invoices before payment, and then pass the tax collected over to HMRC on a monthly basis.

How do you calculate the deduction?

The tax percentage deduction is calculated purely on labour costs. This means that all of the following items need to be added back before the deduction is made:

- VAT

- Materials

- Equipment hire costs

- Motor expenses (i.e. fuel)

Monthly Contractor Returns

Each month all contractors are legally required to submit a return to HMRC detailing the amount they have paid to subcontractors, and the amount held back in tax. This return is due to be filed by the 19th of each month, giving details of the payments made in the previous tax month. Payment is then due by 22nd of the month (so long as the payment is being made electronically).

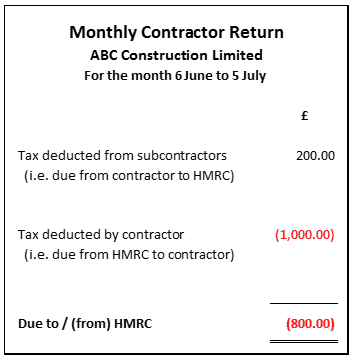

Example

For the month 6 June to 5 July, the return is due to be submitted by 19 July. The payment of any liabilities is then due by 22 July if paying electronically.

Being both a contractor and a subcontractor all at the same time

This case is more common than you would think. For many medium sized construction companies, they are contracted to take on a job by a much bigger firm (hence making them the subcontractor), but then take on subcontractors to help them complete the job (hence making them a contractor).

In these cases they are still required to submit monthly contractor returns, but instead of just listing the payments made to subcontractors, they also list the amount they have been paid by their contractor and the deductions made by them.

As you can see from the example above, this ABC Construction Limited had been deducted £1,000 of tax from their contractor, but only held back £200 from their subcontractors. Hence HMRC owe them £800.

HMRC will not refund CIS tax due back to contractors in this instance unless it is requested in writing. They would expect contractors to continue to “roll over” this balance to the next month until the end of the tax year.

Over payments of CIS tax can then be offset against your corporation tax bill for the year, with all loses being carried forward within the company tax system.

Gross payment status

A company can register for gross payment status if the company turnover (just labour) in the past 12 months was £30,000 per director, or £200,000 for the whole company.

Gross payment status means that your contractors must pay you without making any deduction for CIS tax. Taking this route would then mean that your company would need to make suitable preparations for saving for your corporation tax bill at the end of the year.

More information

This article has given a very brief overview of the Construction Industry Scheme. Please keep an eye out for our new CIS helpsheet (coming soon) which will give a lot more detail and example calculations. This will be free to download from our website.