Money makes the world go round. It is essential for living. So how do you get more of it? This article is going to tell you exactly how you can extract cash from your limited company in the most tax efficient way possible. Leaving your pockets full, and you well within the lines of the law.

It is a common misconception amongst small business owners that once you have got a limited company you can just take whatever money you want out of it whenever you want. We have seen this approach cause more than a few problems for some of our clients recently, and we wanted to take this opportunity to make sure that others don’t make the same mistake.

The first concept to make sure you get your head around is that you and your limited company are two completely separate legal entities. This means that the company is taxed on the profits the company makes, whereas you are taxed personally on the income you take from the company.

How to take money out of your limited company

There are three main ways to take money out of your limited company and these are as follows:

1) Reimbursement / Repayment of Director’s Loan

Before you set up your company you would have earned money elsewhere, perhaps through employment, perhaps through being a sole trader, maybe even through inheritance or redundancy. Either way, you have personal money that has already been subjected to income tax.

If you choose to invest this money into your business (i.e. a director loan into the business) then the business is responsible for repaying that loan to you. Since you have already paid tax on that money previously, the repayment of your money from the company back to you comes with no income tax implication.

Similarly, if you were to buy something for the business out of your personal funds, the business would owe that money back to you (i.e. reimbursement of expenses). Again, the withdrawal of that money from the business would be exempt from income tax because it was declared as income previously and hence has already been subjected to income tax.

2) Salary

Money extracted from the business can only be classified as a salary if it has been formally processed through the company payroll scheme and HMRC have been notified through the RTI (real time information) system.

On your personal tax return the salary proportion of your income would be classified as income from employment, and the tax would have already been paid on a monthly basis through the payroll scheme (if you declare a salary that is high enough to attract PAYE or national insurance).

In 2018/19 the amount you can earn as a salary before you are liable to income tax is £11,850 (i.e. the personal allowance). The amount you can earn as salary before you are liable to class 1 national insurance contributions is £8,424.

3) Dividends

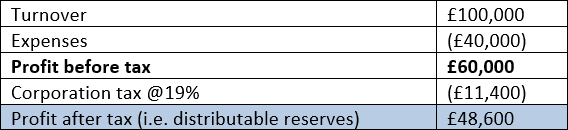

The final way you can extract money from your business is by declaring dividends. The amount of money available in the business to withdraw as dividends is called the distributable reserve. Essentially it is the profit left in the business once corporation tax has been accounted for.

Example calculation:

In this example the director of the company would be entitled to draw dividends in the value of £48,600.

Dividends are subjected to dividend tax at 7.5% in the basic rate band and 32.5% in the higher rate band, with the first £2,000 being tax free (rates for 2018/19).

Top Tip

Whatever cash you take out of your business you must always ensure that you leave enough money in the bank account to cover the corporation tax liability. If you draw money out of the business in excess of the distributable reserves then you will have taken “illegal dividends” which will be subjected to s455 tax.

Conclusion

Now that you know the 3 ways you can take cash out of your business the next step is to determine the right levels for your needs. We would always recommend speaking to an accountant about this to make sure you have a proper plan in place. February is always a great time to schedule in a meeting with your accountant to discuss your tax plan for the upcoming tax year.

If you would like us to give you a review of your tax plan then please contact us on [email protected] or call us on 01634540340.