There are many people out there who rent out property (perhaps their old bachelor pad once they’ve moved in with the lady of their dreams) and don’t realise that in the eyes of the law, this makes them a landlord. As a landlord you are required to register for income tax with HMRC and then declare all profits made from your rental activities, paying the correct level of tax annually. We hope that this article clears up the subject for you.

Is my rental income taxable?

1) Traditional rental income

If you own a property but do not live there and the current occupiers pay you “rent” to be there, then this makes you a landlord. The money you received in rental income may only just cover your mortgage repayment, but this still makes you a landlord, and this income needs to be declared to HMRC.

This covers renting out one single property, multiple properties also any specialist lets such as students or workforces.

2) Rent a room

If you are a single person and you rent out a furnished room in your home, then you can earn up to £4,250 in tax free rental income in any tax year.

If you are a co-habiting or married couple and you rent out a furnished room in your home, then you can earn up to £2,125 in tax free rental income in any tax year each (i.e. per partner).

If you receive more in rental income than the tax free allowance listed above, then you need to disclose this income to HMRC.

3) Live abroad and rent out UK property

If you own a property in the UK that you rent out because you live abroad, this does not give you any form of exemption under the UK tax laws. The income you receive is still classified as rental income, and this needs to be declared to HMRC.

4) Holiday home rental

If you own a home in the UK that you rent out to holiday makers for short periods of time throughout the year (even if you occasionally use the property yourself) the income received is classed as rental income and needs to be declared to HMRC.

How much of the rent is subject to income tax?

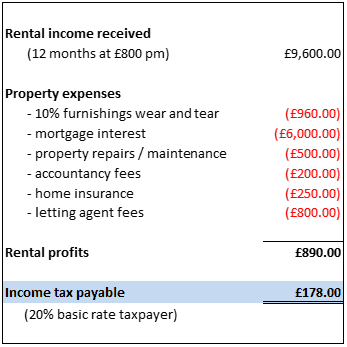

Income tax is charged on rental income once all allowable expenses have been deducted. The rate of tax charged will depend on how much income you have had from other sources in that particular tax year.

Basic rate taxpayers will be subject to income tax at 20% whilst higher rate taxpayers will be subject to income tax at 40% (rates for 2015/16 tax year).

Allowable expenses

“What is classed as allowable expenses?” I hear you ask. Well here is a brief list:

- Mortgage INTEREST – it is very important to note that you can only deduct your mortgage interest from your rental income. The repayment part of your mortgage is NOT allowable for tax purposes. This is why most people who rent out property have an interest only mortgage.

- Letting agent fees

- Accountancy fees

- Property repairs and maintenance costs

- Property insurance

- 10% furnishings wear and tear – if you let out a property that is furnished, you are entitled to a wear and tear allowance which is calculated at 10% of the rental income received.

Conclusion

As you can see from the example above, even though you may receive rental income of £9,600 per year, your liability to income tax could only be a very small proportion of that.

HMRC are cracking down on undisclosed rental income through their Let Property Campaign (article to follow), so the best course of action is to be proactive… go to them before they come to you!