When the economy heads for challenging times, charities are one of the first areas to feel the pinch. With the Government making drastic spending cuts, local authorities are forced to reduce or cease grant funding for charities.

For a lot of local charities the Government grant funding is only a small proportion of their income, with heavy reliance being placed on obtaining donations from the general public in order to continue performing their services.

The Government introduced a scheme called GiftAid back in October of 1990. This scheme is an incentive that enables tax-effective giving to charities in the UK. This scheme, if used correctly, can benefit both the donor (whether that be an individual UK taxpayer or a UK limited company) and the charity.

Individuals

Under the GiftAid scheme if a UK taxpayer donates £100 to a UK registered charity, that person is deemed to have made the donation net of 20% income tax. The charity can then claim back the additional 20% from the Government at no additional cost to the donor.

£100 x 100/80 = £125

Cash given to charity by donor = £100 Cash given to charity by Government = £25 Total received by charity = £125

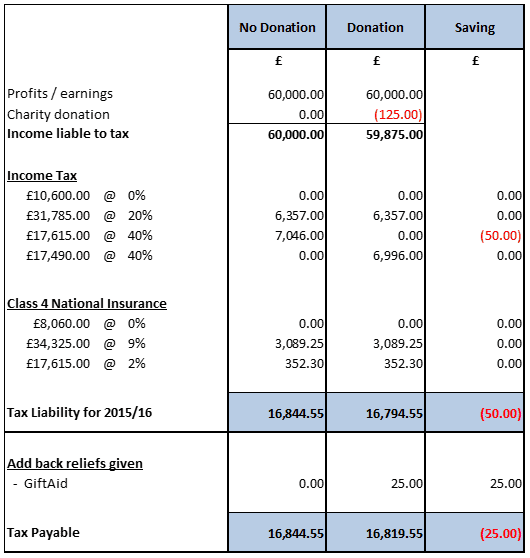

If the donor is a higher rate UK taxpayer then the benefits of donating to a charity under the GiftAid scheme can be even higher. The charity can claim back the 20% as explained above, but then the donor can also claim back 20% on their self assessment tax return (as shown below).

As you can see from the calculations above, for every £100 donation made to a charity under the GiftAid scheme an individual can reduce their liability to income tax by £25.

What you will also notice is that the grossed up donation of £125 reduces an individual’s income that is assessable for taxation purposes.

Limited Companies

If your limited company donates money to a charity then it will gain corporation tax relief (20% for companies with profits of £300,000 or less) on the donation amount.

The specific treatment depends on whether the money donated is classified as a “donation” or as “sponsorship”, but either way the company liability to corporation tax will reduce.

Donation 20% relief is claimed on corporation tax return as a deduction against profits Sponsorship The sponsorship amount is listed as an administration expense on the profit and loss account

So in conclusion, charity donations can positively impact your liability to tax, so please do all you can to help support our local charities and let them continue to do their work. Without financial support they could cease to provide their services, and that would negatively impact the local community. We must stand together in this time of financial hardship, and if we can save a bit of tax in the process then all the better!