On 24th September 2020 the Chancellor of the Exchequer, Rishi Sunak, laid out his plans to help the UK economy survive the Winter months. One of the measures announced in his address to Parliament was a newly developed “Job Support Scheme”. Many business owners are eager to know how this scheme differs from the previous Coronavirus Job Retention Scheme, and how they can use the scheme to help their employees retain their jobs, whilst simultaneously trying to keep their businesses financially viable. Here is what we know.

What is the Job Support Scheme?

The Job Support Scheme has been created to take over from the current Coronavirus Job Retention Scheme which is coming to an end on 31st October 2020. The scheme has been created to help protect viable jobs in businesses who are facing lower than normal demand as a result of the Covid-19 pandemic.

How long will the scheme run for?

The scheme opens on 1st November 2020 and will run for 6 months to April 2021.

How does the scheme work?

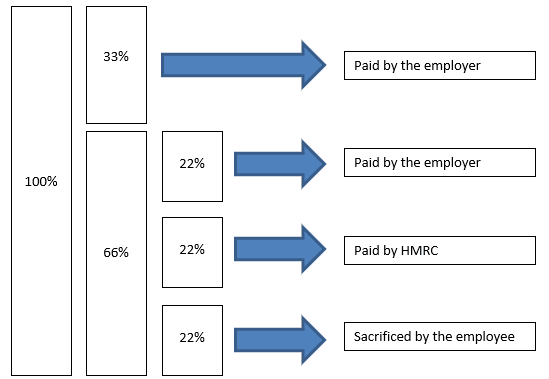

Employers are being asked to bring back their employees to work for at least a 1/3 of their contracted hours which will be funded by their employer in the normal way. The remaining 2/3 of their salary will be split three ways so that they are funded by HMRC (capped at £697.92 a month), the employer, and the employee.

As you can see, this means that the employer will pay 55% of the salary and HMRC will pay 22%, meaning that the employee will get paid 77% of their normal salary.

How is this different from the CJRS?

From the employee’s point of view, under the Coronavirus Job Retention Scheme (CJRS) they were being paid 80% of their standard salary and not having to work at all, whereas under the Job Support Scheme they will receive 77% of their salary and be required to work at least a third of their contracted hours.

However, from the employer’s point of view, under the CJRS they weren’t having to pay anything to keep employees furloughed away from work, but under the Job Support Scheme their employees are required to come back to work for at least a third of their contracted hours, and they are having to pay 55% of their salary. For some businesses this jump in cost will mean that their business is no longer financially viable, resulting in their business having to close down and their employees to be made unemployed.

What can be claimed?

Unlike the CJRS, the Job Support Scheme will only cover gross pay amounts. It will not subsidise employer national insurance or employer pension contributions, which means even more expense for the employer. The payments received from the scheme will be classed as taxable grants, so should be treated just like any other trading income in your accounting records.

Potential changes

After the scheme has been running for 3 months the Government will assess whether the minimum working hours requirement will need to be increased.

For more information on this scheme directly from the HMRC, then please see the guidance at https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/921389/Job_Support_Scheme_Factsheet.pdf

We endeavour to update this information as and when it becomes available to us, but in the meantime if you do need any accounting or taxation help then please don’t hesitate to contact us on [email protected] or 01634 540340.