Tax rates and allowances are constantly evolving year on year, with 2018/19 being no different. April 2018 will see an increase in many tax rates and allowances that you as a limited company owner should be aware of. These upcoming changes will have an impact on your company finances and cashflow, so we want to make sure that you know exactly how they will affect you and your business.

1) Personal allowance

Many us are entitled to a personal allowance each tax year. This is the amount of money we can earn before we start paying income tax. For the 2017/18 tax year this allowance was £11,500. For the 2018/19 tax year this allowance will be £11,850. This is an increase of £350.

2) Income tax thresholds

In addition to getting an additional £350 at 0% income tax, the Government has also made an increase to the basic rate threshold. This means that you can earn more before having to jump into the higher rate band. For the 2017/18 tax year the total amount you could earn before paying higher rate tax was £45,000. In the 2018/19 tax year you will be able to earn £46,350 before paying tax at the higher rate. This is an increase of 1,350.

3) Class 1 national insurance

Class 1 national insurance is the type of national insurance you pay on your employment income. This is income that is processed through a registered payroll scheme. In the 2017/18 tax year you could earn £157 per week (that is £8,164 per year) before being subjected to class 1 national insurance. In the 2018/19 tax year this amount will increase to £162 per week (this is £8,424 per year). This is an annual increase of £260

This is great news for any limited company director who is paying themselves a basic salary and topping up their income with dividends.

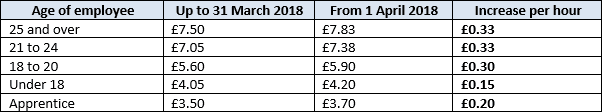

4) National living and minimum wage

From 1 April 2018 national living wage and national minimum wage are increasing. This will have a big impact on your business finances and cashflow if you are paying your staff the minimum. The changes are as follows:

Please note that it is illegal to pay your employees less than the national minimum or living wage for the number of hours they work. For more information please see https://www.gov.uk/national-minimum-wage

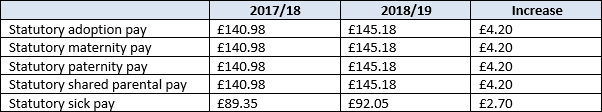

5) Statutory payments

There are many statutory payments that employers are required to make to their staff in certain scenarios, which they can later reclaim through their payroll scheme. From 6 April 2018 these statutory payments will increase as follows (all rates shown are per week):

A reminder that as an employer you can usually reclaim 92% of these statutory payments from the Government, but if you qualify as a small employer you can reclaim 103% of these payments.

6) Student loan deductions

Good news for any of your staff who are currently suffering student loan deductions. The earnings limits will increase in April 2018 to £18,330 for plan 1 and £25,000 for plan 2. This means that they can earn more before they are required to start paying back their student loans.

7) Employment allowance

Small employers that meet the criteria for the employment allowance are entitled to £3,000 off their national insurance bill in each tax year. This amount will not change in the 2018/19 tax year.

8) Dividend Allowance

A very important change happening from 6 April 2018 is the reduction of the dividend allowance. In the 2017/18 tax year company directors were able to draw £5,000 of dividends from their company without having to pay any income tax. In 2018/19 this allowance is being reduced to £2,000. That is a reduction of £3,000.

Overall these changes are a very mixed bag. On one hand directors of owner managed limited companies will be able to increase the amount of tax free drawings they can make from their companies, but on the other hand they will now have to pay their staff more to continue operating their businesses as they are currently.

To see the full list of rates, thresholds and allowances for 2018/19 please see the HMRC website at https://www.gov.uk/government/publications/autumn-budget-2017-overview-of-tax-legislation-and-rates-ootlar/annex-a-rates-and-allowances