Taking the plunge into self employment is both an exciting and daunting prospect. Whether you decide to become a sole trader or the director of a limited company, you will be the one who is responsible for providing good quality goods and services to your customers. However, what most fail to realise is that you also become responsible for keeping good quality financial records. This article aims to outline what constitutes good quality records, and what the basic requirements are for sole traders.

Legal Requirements – Sole Traders

All business entities are required to keep records by law, however the requirements for sole traders is slightly more relaxed than the requirement for limited companies. Sole traders are required to keep records of the following:

1) All sales and income

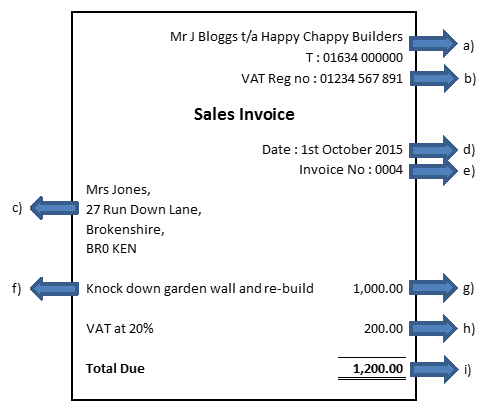

When you provide your customers with goods or services you are required to issue them with a sales invoice. This invoice should detail the following:

a) Your business name and contact details.

b) Your VAT number (if registered).

c) The customer’s name and address.

d) The date the goods or services were supplied.

e) An invoice number (these should be sequential).

f) A brief description of the goods or services supplied.

g) The cost of the items supplied (i.e. the sales value).

h) VAT at the appropriate rate (if registered)

i) The total cost due by the customer.

You are required to keep a copy of this invoice for your records. You can chose whether you keep a hard copy in a physical folder, or whether you keep an electronic version saved on your computer somewhere. Either way, in the event of a tax inspection, you would need to be able to produce your copies of all sales invoices raised in a given period.

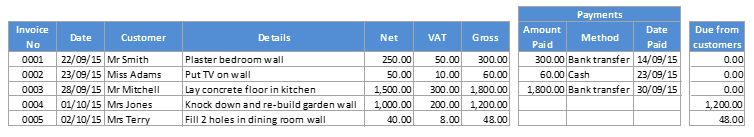

You should also keep a central log of all sales invoices raised, and ideally note down when and how they were paid. This helps you to determine who owes you money at any given time, and will also help you match income on your bank statements back to a copy of a sales invoice.

2) All business expenses

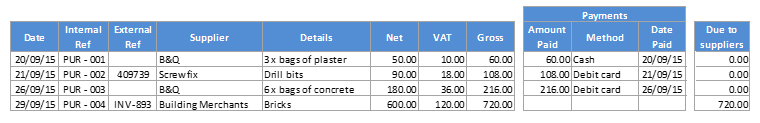

When you buy something for your business you will be issued with a receipt (also known as a purchase invoice). It is essential that you keep hold of these. Again, you can choose whether to keep them all in a physical folder, or whether to store electronic copies of them on your computer.

** HMRC now accepts good quality scans or photographs of purchase invoices as evidence **

Again, you should also keep a central log of all purchase invoices received, and ideally note down when and how they were paid. This will help you to determine how much money you owe to your suppliers at any given time.

You will notice on the above example that I have given each purchase invoice an internal reference. It is important to do this so that you can easily locate the invoice when asked to for any form of tax inspection. I would recommend writing this reference onto the purchase invoice somewhere and then filing in sequential order.

3) VAT records (if registered for VAT)

You will notice on the above example that I have given each purchase invoice an internal reference. It is important to do this so that you can easily locate the invoice when asked to for any form of tax inspection. I would recommend writing this reference onto the purchase invoice somewhere and then filing in sequential order.

4) PAYE records (if registered for PAYE)

If you employ people then you will be registered for a PAYE scheme. You need to keep files (again either paper or computerised) with copies of all the payroll summaries, and copies of payslips issued to each member of staff on each payroll run (weekly, fortnightly, monthly).

5) Any additional personal income

If you have any other income that does not come from your trade such as rental, pension or savings income, then you will need to keep all records of this income too. Statements and letters, etc all need to be filed away so that they can be referred to at a later date and used to generate your tax liability for the year.

How long do I have to keep these records for?

It is a legal requirement to keep all of the records mentioned above for at least 5 years following the 31st January submission deadline of the relevant tax year.